North River Capital is a private equity capital firm headquartered in Fort Wayne, IN. North River is funded exclusively by its principals for the purpose of directly investing in the private equity space. Using the principals' in-depth, working knowledge of operations and strategic growth, North River seeks to grow its portfolio companies through a philosophy of investing in strong management and key capital (growth/productivity) while fostering a collaborative, team approach to human resources.

North River Capital is a private equity capital firm headquartered in Fort Wayne, IN. North River is funded exclusively by its principals for the purpose of directly investing in the private equity space. Using the principals' in-depth, working knowledge of operations and strategic growth, North River seeks to grow its portfolio companies through a philosophy of investing in strong management and key capital (growth/productivity) while fostering a collaborative, team approach to human resources.

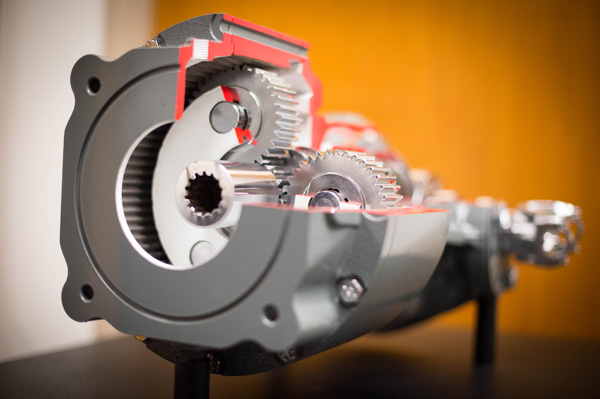

North River’s investment objective is to seek manufacturing companies with a strong management team and an identifiable niche in its industry. While North River is open to many industries, its “sweet spot” is manufacturers that utilize metal in their product and sell primarily to industrial companies. North River targets companies with EBITDA in the range of $4 to $8 million with latitude on either side for a target that fits well with a current portfolio company.

Since North River only invests the funds of its principals, the investment horizon and strategy deployed have significant flexibility. North River prefers to invest in companies with a long-term hold strategy and an emphasis on strong organic growth, while maintaining the option to grow through strategic acquisition. Since inception, North River has sold only one portfolio company in the industrial space.

Since North River only invests the funds of its principals, the investment horizon and strategy deployed have significant flexibility. North River prefers to invest in companies with a long-term hold strategy and an emphasis on strong organic growth, while maintaining the option to grow through strategic acquisition. Since inception, North River has sold only one portfolio company in the industrial space.

North River’s approach to its portfolio companies is based on the extensive operating experience of the principals. All of the principals at North River boast from 25 to 35 year's experience in operational, management and executive positions across a broad range of industries, including mining, automotive, service and most recently scrap processing. As executives at OmniSource Corporation, one of the largest scrap processors in the country, the North River team’s most recent significant achievement was the growth and ultimate sale of OmniSource to Steel Dynamics in 2007 for over $1 billion.

Prior to that sale, OmniSource Corporation was a privately held company owned by the Rifkin family from 1943 to 2007. From a family startup, the company grew to almost $3 billion in revenue with 50 locations and over 2500 employees. The most significant growth occurred between 1998 and 2007 under the direction of North River’s principals that served as executives of the company. During that time, OmniSource acquired or started over 30 companies/facilities and grew revenue by over 500% and profits by over 700%. This growth was directly related to the North River team’s philosophy of investing in strong management and key capital while using a collaborative, team approach to human resources, all of which was applied to achieve a clear strategic vision.

Prior to that sale, OmniSource Corporation was a privately held company owned by the Rifkin family from 1943 to 2007. From a family startup, the company grew to almost $3 billion in revenue with 50 locations and over 2500 employees. The most significant growth occurred between 1998 and 2007 under the direction of North River’s principals that served as executives of the company. During that time, OmniSource acquired or started over 30 companies/facilities and grew revenue by over 500% and profits by over 700%. This growth was directly related to the North River team’s philosophy of investing in strong management and key capital while using a collaborative, team approach to human resources, all of which was applied to achieve a clear strategic vision.

North River believes that its competitive advantages in the private equity space are its long-term investment horizon and approach to human resources. These advantages were born out of the approach used to grow OmniSource to be a dominant force in the scrap industry while maintaining an employee friendly, family-owned atmosphere. This approach is perfectly suited for the seller who is keenly interested in perpetuating the culture and security of their employees while maximizing value in a sale process. The North River team is noted for providing strategic guidance, operational insights, and a family-owned human resource style to its portfolio companies.

Click here to read our Investment Focus & Guidelines.

Click here to read our Investment Focus & Guidelines.